Data Story: Merkle Tree & Proof-Of-Reserves (PoR)

Maybe you have heard of the FTX collapse recently; maybe a tad too much. But this event has indeed triggered a restructuring in the whole cryptocurrency’s ‘wild west’, meaning transparency, in its entirety, has become a major prerequisite for investors. Time to utilise blockchain technology and its intrinsic transparency as well as immutability - we will need first to understand the concepts of Merkle Tree and Proof-Of-Reserve.

Merkle Tree Basics

The short description of Merkle Tree is: A data structure that serves as a summary of all the transactions in a block.

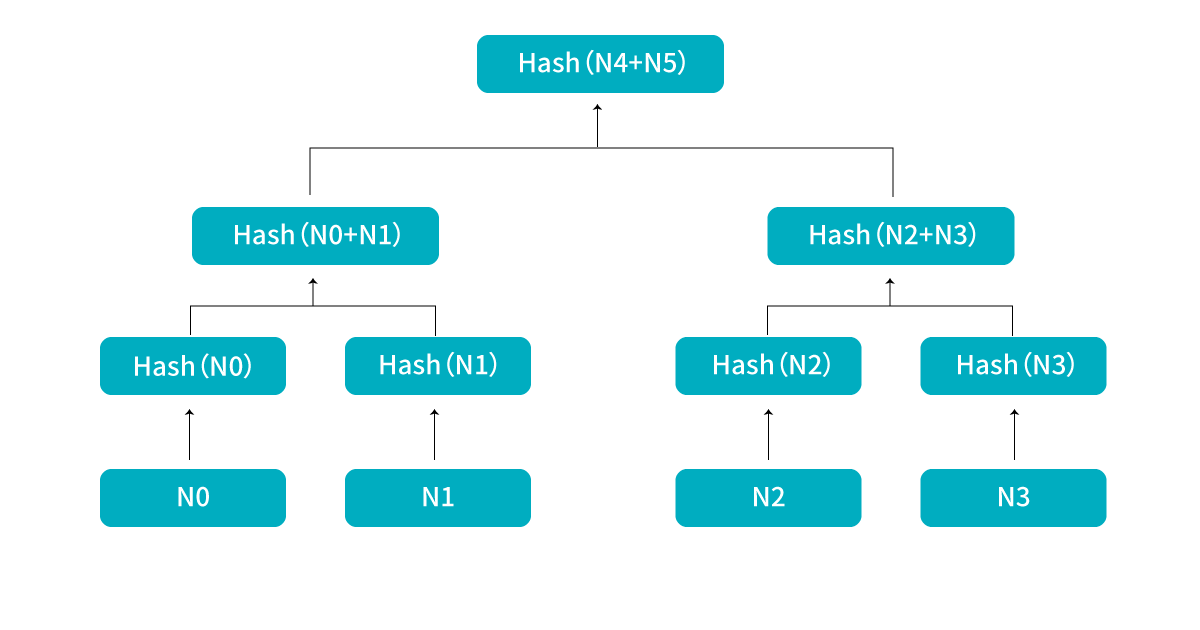

The detailed version: Merkle Tree, also known as a binary hash tree, is created by hashing together pairs after pairs of hashed transactions until there is one single hash for the whole block. In the example below, N0, N1, N2, and N3 represent Transaction Number 0, Transaction Number 1, Transaction Number 2, and Transaction Number 3, respectively. Each transaction, when carried out, is given a unique hash (Hash N0, Hash N1, Hash N2, Hash N3). Combining the hash of N0 and N1, we get a new unique one known as Hash(N0+N1); Hash(N2+N3) is the result of the same process. Repeat this step until Hash(N4+N5), which can be considered the merkle root/root hash of this dataset.

Now back to our Blockchain101 knowledge. First of all, data stored on blockchains is connected because each block contains the hash of the previous block. If one transaction of any existing blocks is changed/modified, a new defining hash is created for this one, and consequently changes layers of current hashes up to the root, invalidating the entire block and all blocks created later.

What does it mean for us (the non-tech), after all? The Merkle Tree provides consistent, unalterable, and indelible data storage that we can leverage to track the transaction history of any wallet address. It takes some time to verify each relevant hash, but we’ll always know if there are any changes - the corresponding hashes no longer hold.

Why We Need Proof-Of-Reserve

Proof-Of-Reserve is evidence that one centralised entity has a reserve of 1:1 ratio to users’ funds. That is, users are guaranteed that their funds are withdrawable. It’s never too late for crypto centralised exchanges (CEXs) and other custodian service providers (firms that hold possession of user wallets’ private keys and thus possession of users’ funds) to disclose a verifiable audit to prove their solvency and no mishandling of users’ funds, be it public wallet ownership, through cryptographic proofs or via third-party auditing services. The official financial soundness indicator - the reserve ratio (the ratio between a firm's existing funds and users’ funds) - must be at least 100% to make sure that #FundsAreSAFU.

Bitget Is Committed To Maximum Transparency

As the leading builder in the digital space as well as in the CEX sector, Bitget’s number one priority is to ensure transparency for everyone at any time. At the current reserve ratio of 244% (snapshots taken on December 02, 2022 at 6:50 AM UTC), what Bitget holds in our wallets are nearly 2.5 times of the total users’ assets in BTC, ETH, and USDT. This figure will be updated on a monthly basis so that our users can stay up to date about our platform’s solvency situation and our liquidity level as well.

Our BTC, ETH, USDT, and relevant addresses are publicised here and the open-source code for Bitget’s solvency program has been updated to Github. That means everyone, literally everyone, with or without a technical background has 24/7 access to Bitget’s Proof-Of-Reserve. Don’t forget to check out our US$300 million Bitget Protection Fund and the US$5 million Bitget Builders Fund - we provide not only coverage for any potential loss of users’ funds, but also support for affected FTX users in a well-prepared and timely manner.

Finally, a detailed guide on asset verification is already published here so that Bitget users can check their accounts whenever they feel needed. Monthly snapshots of each users’ fund will also be available publicly, of course after we censor the sensitive information. That way our users can have 100% confidence in Bitget’s ability to fulfil users’ requests for withdrawals, together with our users’ 30-day crypto statements.

See Bitget Reserves Certifcate for yourself

CEXs are still a fundamental part of the crypto ecosystem, providing simple, ultra-liquid trading services, easy onboarding for new users, and on-ramp/off-ramp services for crypto investors worldwide. At the end of the day, transparency is the key to mainstream crypto adoption - the fall of FTX is giving us a golden opportunity to restructure and innovate, persistently.

- Blockchain 101: What Is A Modular Blockchain?2024-06-07 | 15m